Quiet Contrarian. Ep 24: Half Year Portfolio Update 2021

Portfolio Performance

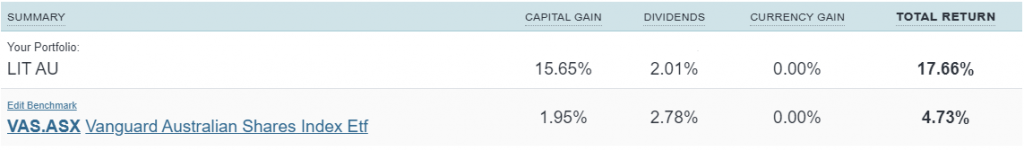

Portfolio has done well again, managing to outperform my benchmarks by ~10% depending on which one you want to look at. Here’s a bit of background on the Benchmarks I’ve been using:

- VAS – Vanguard Australian Shares ETF – Tracks the S&P/ASX 300 Index – Best for comparison to the Australian market

- VOO – Vanguard S&P 500 – Tracks the United States S&P 500 Index, in USD – This is best for a direct comparison of USD stocks.

- VDHG – Vanguard Diversified High Growth Index ETF – This is a composite ETF tracking a number of indexes. – This is meant to be a globally diversified “all-weather” option. One of the favourite fire and forget/DCA options for the /fiaustralia reddit group.

Best part of the year was through October as my portfolio accelerated away from the benchmark, thought I did lose some of that ground through Nov-Dec. Overall I’m happy with the continued outperformance.

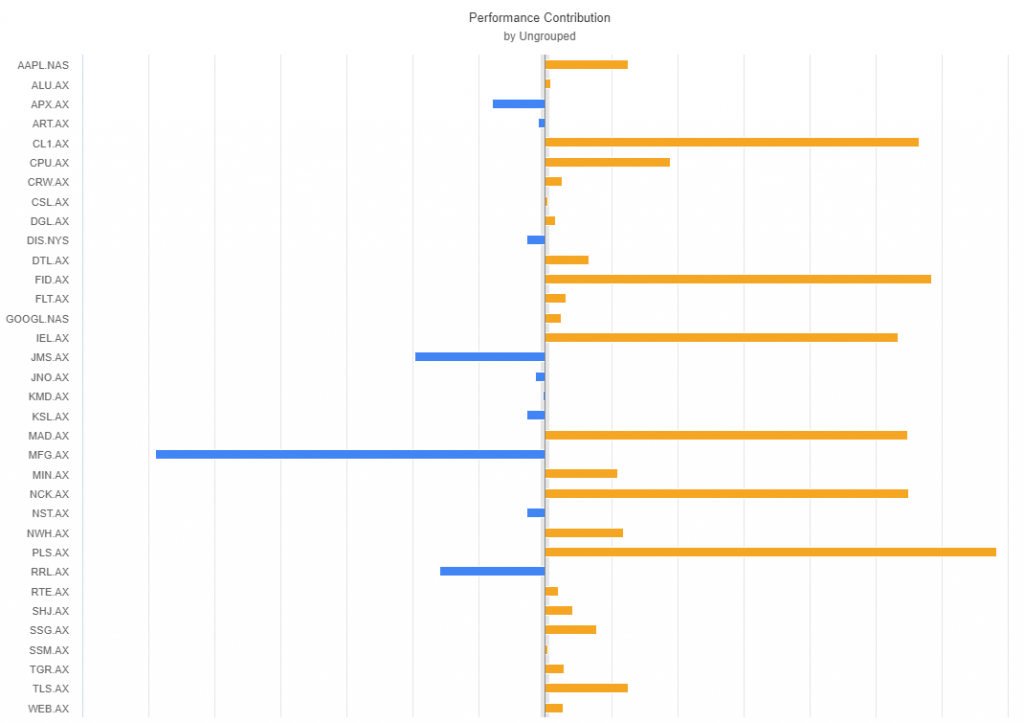

Best and worst performers

- The top 3 profitable holdings for the half year were: Pilbara Resources, Fiducian Group, and Class Limited

- The best performers in % terms were: Mader Group, Pilbara Minerals, Class Limited.

Pilbara has been one of the standouts in my portfolio for the last year. Leading the charge in the new Lithium wave, I regret only starting with a small position in these guys, as they’ve become my first holding to go 10x. Fiducian group had been cruising along slow and unnoticed for a long time, but have recently accelerated away, my read is that they’re riding the broader market PE expansion. Class limited was also acquired for a princely sum, as part of the recent MnA boom. Which is great, but also makes me nervous as to the market’s position. Mader group is a newly listed mining services contractor, that had good figures at a reasonable multiple, bit risky as I picked them up before the numbers had settled (which from what I’ve seen seems to be common with IPOs), but they seemed pretty straight shooting, and this bet paid off.

- The worst 3 loss making holdings have been: Magellan Financial Group, Jupiter Mines, and Regis Resources.

- The worst performers in % terms were the same three: Juno Minerals, Magellan Financial Group, and Jupiter Mines

The worst performers are far more painful this year than last, though I’m happy to ride things out for a long hold on pretty much all of them. Magellan and Regis were extremely bad timing on cyclical stocks by me. Magellan’s defensive focused FUM business just isn’t popular in a hugely profitable bull market, I suspect they’ll do well 1-2 years after a significant market correction. Regis had a number of bad decisions/luck (their gold hedge book, slow McPhillamys approvals, bad sentiment around the Tropicana purchase), and their price has been reamed for it. I think that both these guys actually represent extremely good value for money at the moment, and am keeping an eye on them to double down. Ironically Juno was spun out of Jupiter Mines, and both of them make an appearance here. Juno is a tiny holding, that listed well, but has been punished due to the drop in the Iron Ore price, and Jupiter Mines has been punished due to internal strife from the Juno spin-off.

Goals and positioning review

These were my goals and comments from the EOFY. Notes on my progress in italics

- Improve portfolio management. The aim is to move towards being regularly fully invested, rotating the portfolio into and out of sectors/holdings as they become over/undervalued. – I’ve been struggling with this one. I prefer to have a small amount of dry powder. I’m not a fan of needing to make buys/sells at times that don’t suit me. I feel like my last plan is actually more suited to my personality, holding more/less cash in line with TMC/GDP levels

- Analyse more companies and improve my circle of competence. – Been failing on the first part of this, but have continued the trend of reading, so maybe the second part is getting better?

- Try to understand trading strategies a bit more. May devote a small part of my holdings to running a trading portfolio. – Not really done much on this one. Still on the cards.