Quiet Contrarian. Ep 32: FY22 Reflection

Overall update – Story of the year

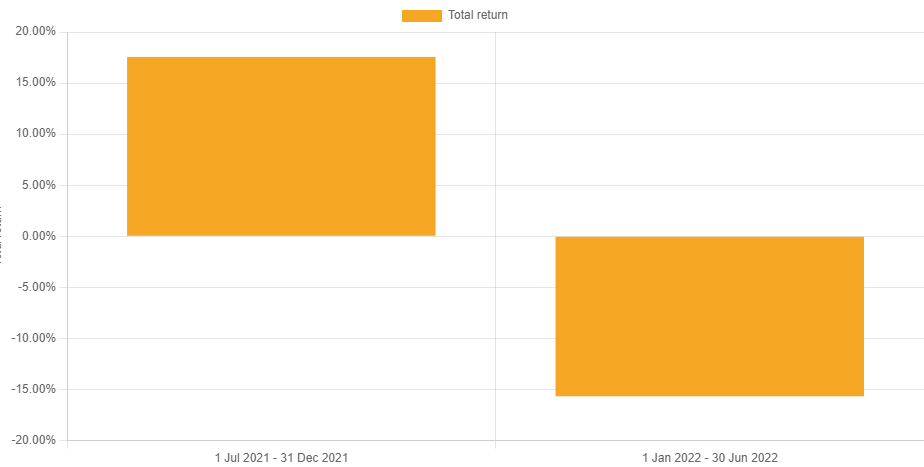

FY22 was definitely a tale of two halves, after having another bumper first half, I ended the year roughly where I started. I noted a number of times through the year that the market was at all time highs, and as it turns out, those were the times I should have taken profit. This reminds me of the main lesson from What I learned losing a million dollars, focus on the defensive: it’s better to forgo some of the profit than it is to lose money.

FY22 Goals and Positioning Recap

This was a bit of a transition year for me. Looking into learning, refining, and understanding more than anything else.

- Improve portfolio management. The aim is to move towards being regularly fully invested, rotating the portfolio into and out of sectors/holdings as they become over/undervalued.

- I tried to do this, but it doesn’t feel good. I don’t like the pressure of having to make rotational trades on the same day. I prefer to sit on the cash, and make trades as I feel better opportunities come up. Sometimes it just doesn’t feel right to be buying into the market. I prefer to absorb on the cash drag and be patient with looking for opportunities.

- Analyse more companies and improve my circle of competence.

- This year definitely wasn’t a big one for company analysis.

- Try to understand trading strategies a bit more. May devote a small part of my holdings to running a trading portfolio.

- Didn’t do it, don’t think it really suits my temperament. But kind of still want to try. Not sure that’s wise.

Portfolio Performance

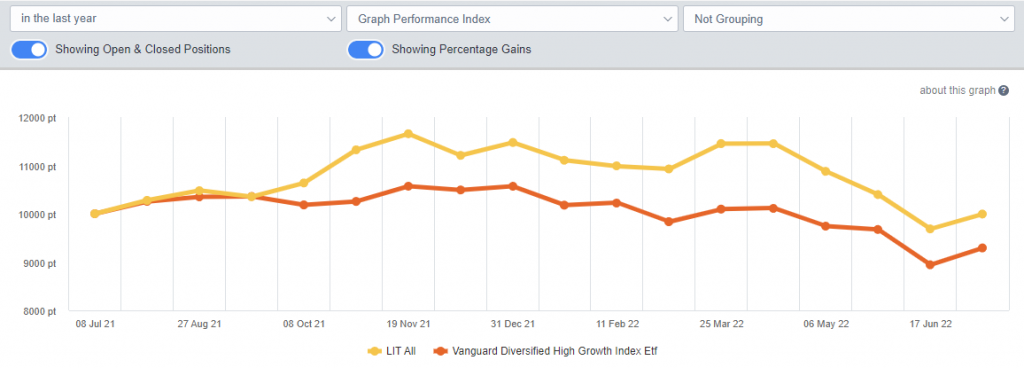

I beat the market again, but it’s not really much of a win given that overall it’s pretty flat (*Note – data is from 8 July, so not exactly right for the FY, but not really too different).

| Portfolio/Index | Capital Gain | Dividends | Currency Gain | Total Return |

| LIT ALL | -4.62% | 4.18% | 0.39% | -0.07% |

| *AU | -3.97% | 4.32% | 0% | 0.36% |

| *US | -19.83% | 0.30% | 9.51% | -10.03% |

| VAS.ASX | -12% | 8.47% | 0% | -3.53% |

| VOO.ASX | -11.48% | 1.47% | 9.51% | -0.50% |

Best and Worst Performers

- The top 3 profitable holdings for the year were: Mader Group, Class One, and Computershare

- The best performers in % terms were: Mader Group, Class One, and Computershare

- The worst 3 loss making holdings have been: Magellan Financial, Regis Resources, and Nick Scali

- The worst performers in % terms were: Magellan Financial, Kalium Lakes, and Appen Ltd

The only thing in common with all of the winners is that they come up as “Quality companies” from a ROE and Balance sheet perspective. This reinforces that “Quality as a fair price” should be the main picks in my portfolio.

The losers however, are a great example of how wrong this can all go. As the 2 of the biggest losers by cash value are also “Quality at a fair price” companies, and prior to this had some really gangbuster results. A good reminder to take profits when valuations get ahead of themselves (Computershare, I’m looking at you and your interest rate based business model). The other major lesson is to be more patient (again), and don’t try to catch falling knives (Magellan, which I am beginning to realise is probably just a proxy for the US market).

Two of the losers in % terms are once again speculative investments. Which reinforces the much lower weightings of them in the portfolio.

Investment behaviour

Good choices

- Refinement and understanding of my personality and how that plays into investment choices.

- Patience. Waiting for truly reasonable prices before buying.

Bad choices

- Created justifications and ignored predetermined triggers.

- Had a number of occassions where I bought a company before doing proper research.

FY23 Goals

- Be more disciplined. I set targets and thresholds last year, and I didn’t listen to them.

- More stock research. Process more companies.

Keeping it simple this year. Try to keep nimble and adapt to the current “interesting times”.