Quiet Contrarian. Ep 38: Half Year Portfolio Update 2023

Portfolio Performance

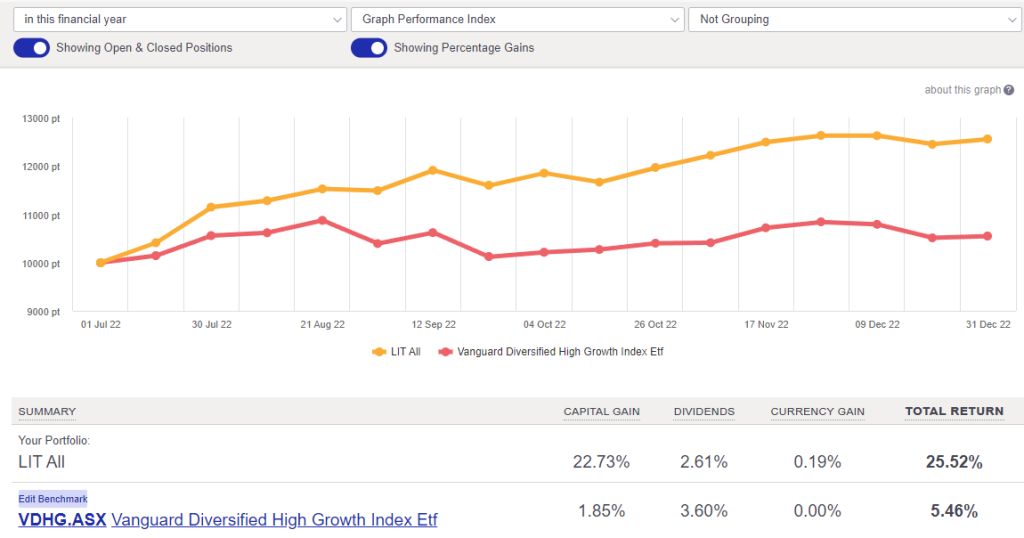

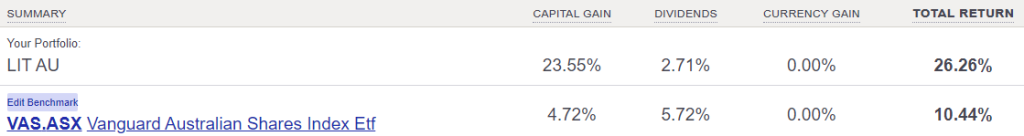

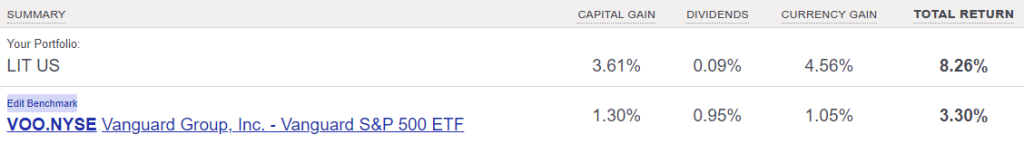

Portfolio has done well again, managing to outperform my benchmarks by ~5-20% depending on which one you want to look at. Here’s a bit of background on the Benchmarks I’ve been using:

- VAS – Vanguard Australian Shares ETF – Tracks the S&P/ASX 300 Index – Best for comparison to the Australian market

- VOO – Vanguard S&P 500 – Tracks the United States S&P 500 Index, in USD – This is best for a direct comparison of USD stocks.

- VDHG – Vanguard Diversified High Growth Index ETF – This is a composite ETF tracking a number of indexes. – This is meant to be a globally diversified “all-weather” option. One of the favourite fire and forget/DCA options for the /fiaustralia reddit group.

I do feel like a recession is likely in CY23, and have been slowly increasing my cash holdings as the market looked overpriced (timing hasn’t been perfect, but that’s ok). Overall I’m happy with the continued outperformance. No trades for December, just reporting that here, and won’t bother putting up a separate post about it.

Best and worst performers

- The top 3 profitable holdings for the half year were, both in dollar and % terms were: Pilbara Resources, NRW Holdings, and Northern Star

- The best performers in % terms were: Pilbara Minerals, NRW Holdings, and Bellevue Gold

Pilbara continued their massive tear, almost getting to $6, which would have been 20x for me. But they have fallen back off the back of a softening Li price, and reduced Chinese demand for electric vehicles. I think the price is all dependent on the Li price, and at the moment I’m just playing chicken with the supply that’s oncoming over the next few years. Should sell down, currently price fixed at $6. NRW Holdings have been scoring lots of infrastructure and contract wins. They are continuing to grow their pipeline, will be cyclical, but feel like there is more cycle to go. Northern Star and Bellevue are both gold players, rising off the recent gold price strength, and recession fears.

- The worst 3 loss making holdings have been: Appen, Service Stream, and Kalium Lakes

- The worst performers in % terms were: Appen, Kalium Lakes, and Alphabet.

Appen’s business model may be dying in a ditch. They seem to be losing contracts left right and centre. Though there does seem to be some renewed interest in AI, will this lead to a cycle of new contracts? Service Stream was losing NBN contracts, then they had a horrific FY22 with a number of one-off losses leading to reduced margins. They have been punished by the market but are still a well run company, their radio silence is worrying and has caused the price to drop further. They could bounce back heavily with just a little bit of good news. Kalium Lakes, I have less and less faith in these guys. The concerns over their process has me quite worried. If they do get their factory functioning the price will go gangbusters. But I am a bit worried about their performance. Alphabet being on this list was quite a surprise, and if I’m honest I’m not really sure what’s happening with them, outside of the American market contracting from it’s bubbly highs.

Goals and positioning review

I have been slowly taking profits and increasing my cash positions. I do feel like there is a recession coming, and stocks will be punished through 2023. I’m currently at about 35% cash, a little more wouldn’t be bad. But not too much more. What if I’m wrong and we bounce back hard and fast? Lots of uncertainty, and interesting times.