Quiet Contrarian. Ep 45: FY23 Reflection

Overall update – Story of the year

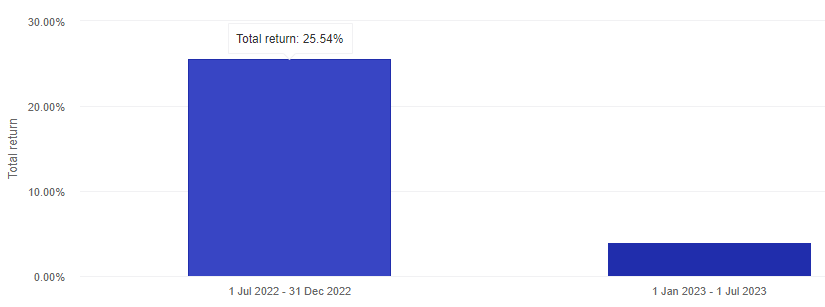

FY23 was looking like a pretty similar tale of two halves, to FY22. Though this time I timed it a bit better. Taking out profit at market peaks near December, though I’m not sure it was quite as successful as last year, as the second half was still nett positive, definitely won a few (IEL) but lost a few gains too (MAD). I’m still sitting on about 50% cash, and forecasting a market crash later in the year as the interest rates really bite the Aussie mortgage holders (my opinion only).

FY23 Goals and Positioning Recap

This was a bit of a transition year for me. Looking into learning, refining, and understanding more than anything else.

- Be more disciplined. I set targets and thresholds last year, and I didn’t listen to them.

- I did better this year. I took losses earlier. I set my targets and I adhered to them with more discipline.

- More stock research. Process more companies.

- I improved my circle of competence a little. Have been looking more into microcaps, and mining explorers and juniors. Still not great at it, but definitely learning.

Portfolio Performance

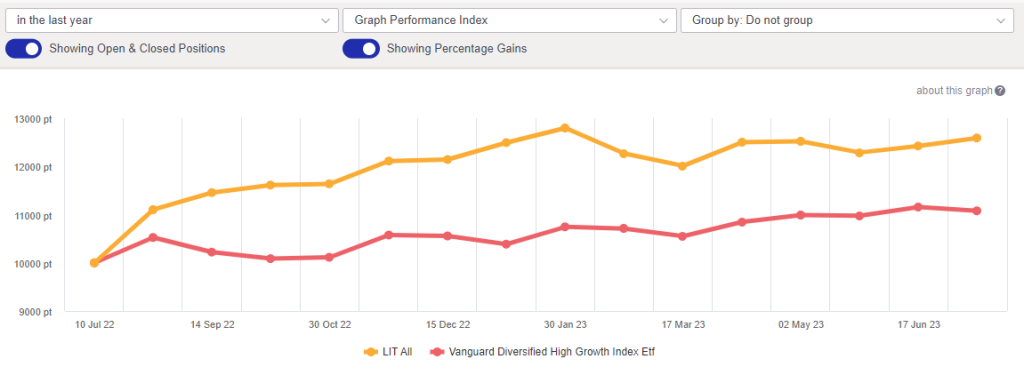

I beat the market again, but it’s not really much of a win given that overall it’s pretty flat (*Note – data is from 10 July, so not exactly right for the FY, but not really too different).

| Portfolio/Index | Capital Gain | Dividends | Currency Gain | Total Return |

| LIT ALL | 21.57% | 4.11% | 0.22% | 25.90% |

| *AU | 22.47% | 4.29% | 0% | 26.76% |

| *US | 1.63% | 0.09% | 5.19% | 6.90% |

| VAS.ASX | 4.67% | 6.05% | 0% | 10.72% |

| VOO.ASX | 13.12% | 1.80% | 2.84% | 17.76% |

Best and Worst Performers

- The top 3 profitable holdings for the year were: Pilbara Minerals, Northern Star, and Mader Group

- The best performers in % terms were: Bellevue Gold, Pilbara Minerals, and Northern Star

- The worst 3 loss making holdings have been: Fiducian Group, Appen, and Kalium Lakes

- The worst performers in % terms were: Appen, Juno, and Airtasker

This was a year all about commodities, Lithium finally started hitting that supply shortage as EVs started taking off. Shifting pricing power to the miners. And gold took off as people got scared about the economy, and inflation started to bite. Mader Group rode all of this, and had an additional boost by the labour numbers.

Losers are much more individual stories this time: ART is an unprofitable tech company that isn’t so shiny in a high interest rate environment. Appen has been imploding as it’s labour hire to train AI model seems to be failing, KLL can’t seem to get their refinement process to work and has been hitting delay after delay. And finally JNO a spin off of JMS which I got in a distribution, and tbh I have no idea what is happening.

The difference between the % and real money losses of the losers once again reinforces that I should put lower investments in speculative investments of the Lynchian Whisper Stocks variety.

Investment behaviour

Good choices

- Took wins when the market was overexuberant.

- Adjusted position size to account for lack of understanding of the company.

- Patience. Waiting for truly reasonable prices before buying.

Bad choices

- Still a bit impulsive, had to do the due diligence after a buy triggered.

- Still not moving to contain losses as fast as I should (remember both losses and gains are exponential, curb the losses fast, let the gains run).

FY23 Goals

“Second verse same as the first” – The Ramones. Keeping next years goals the same.

- Continue to work on discipline. Defensive investing provides the best bang for buck.

- More stock research. Process more companies. Do better this year.