Quiet Contrarian. Ep 51: Half Year Portfolio Update 2024

Portfolio Performance

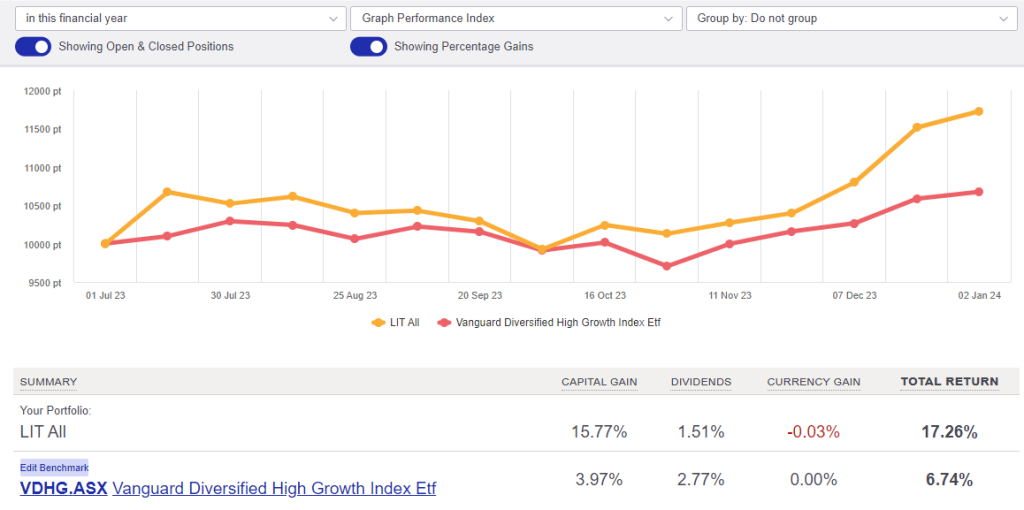

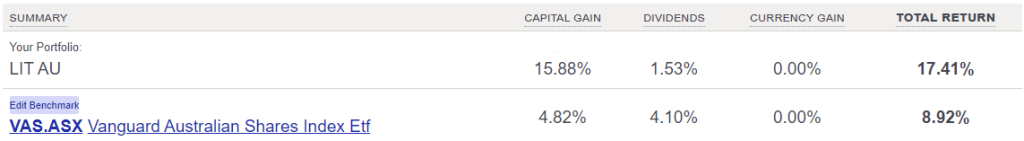

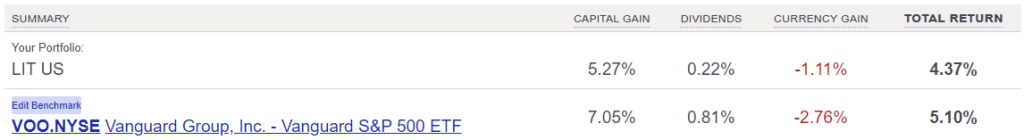

I was surprised by the result. I felt like I’d been doing badly, but overall the portfolio has done well again, though it is split by region. In Australia (and overall) I have outperformed my benchmarks by ~8-10%, whilst in the US I underperformed by ~1%. Here’s a bit of background on the Benchmarks I’ve been using:

- VAS – Vanguard Australian Shares ETF – Tracks the S&P/ASX 300 Index – Best for comparison to the Australian market

- VOO – Vanguard S&P 500 – Tracks the United States S&P 500 Index, in USD – This is best for a direct comparison of USD stocks.

- VDHG – Vanguard Diversified High Growth Index ETF – This is a composite ETF tracking a number of indexes. – This is meant to be a globally diversified “all-weather” option. One of the favourite fire and forget/DCA options for the /fiaustralia reddit group.

I called a recession at the last Half Yearly, and it is yet to materialise, with the likelihood of it happening dwindling, as America seems confident it will have the fabled “soft landing”. I’m not entirely convinced yet. Still on team Bear. I still have far too much cash (~40% of portfolio) so the numbers aren’t perfect. As they don’t factor that in. But even mostly out of the market I should be beating the benchmarks.

I only made one trade in December, topped up a small amount of RKN. Didn’t think it was worth putting up another post for it, as I’d already discussed the company a few times. So just reporting it here.

Best and worst performers

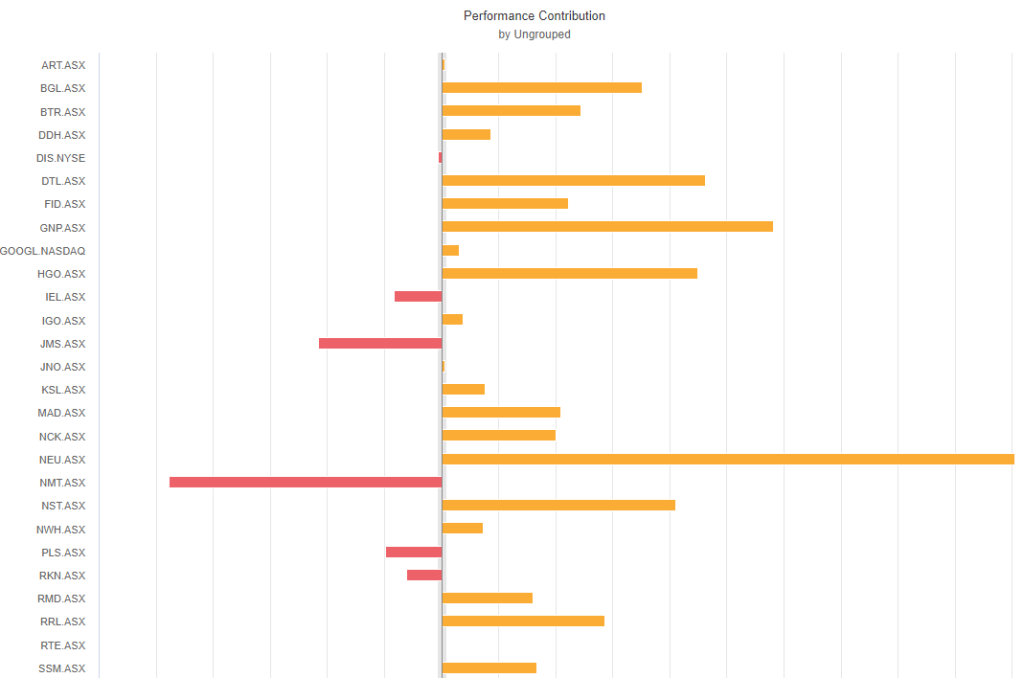

- The top 3 profitable holdings for the half year in dollar terms were: Neuren Pharmaceuticals, Genusplus Group Ltd, and Data#3 Ltd.

- The best performers in % terms were: Neuren Pharmaceuticals, Hillgrove Resources Ltd, and Brightstar Resources

Neuren was one I picked up a few months back, off their pivot to profitability. They are an orphan drug company, and their first product finally went to market. They have a royalty structure attached to sales of the drug, and it is growing faster than expected. On top of that they have more drugs in clinical trials now. Genusplus Group is an industrial services company that specialises in power line construction. They are riding the wave of Rewiring work for the decarbonisation/electrification thematic, and their pipeline has been growing well. Data#3 is one of my long held companies, I picked them up back in 2017 or so, before their pivot to SaaS and they’ve been a great winner. I only hold a small amount now, as I am a bit concerned about their high PE, but they still seem to have some life in them. Hillgrove and Brightstar are both microcap miners, that have a similar thematic “cheap restart” of old facilities. HGO is Cu. BTR is Au. They are both getting going next year, and seem to be performing well and on track.

- The worst 3 loss making holdings have been: Neometals, Jupiter Mines, and Pilbara minerals

- The worst performers in % terms were the same three but in a different order: Neometals, Pilbara minerals, and Jupiter Mines.

Neometals is an innovative battery materials producer. They are working with car companies to use their proprietary tech to recycle batteries (alongside the upcoming EU regulations). Their model has been alot of JVs, proof of concept, and prototype facilities. Their share price has been bleeding out for a while, as they stopped being darlings, and I saw it as an opportunity to get in. But then a few JVs fell apart and they got hit with a few solid punches. PLS, how the mighty have fallen, they crashed back to earth with the Li price in the first half of this FY. JMS is one of the worlds cheapest manganese miners, with no growth and a huge dividend. After a whole bunch of board shenanigans, a spill, replacement of CEO etc etc. They have put forward new aspirations to be the worlds biggest Mn miner. Mn price isn’t doing great at the moment, so no one seems particularly interested. I’m just looking for opportunities to get out.

Goals and positioning review

I have been slowly deploying the cash I accumulated last FY, I got to about 60% cash over the last year, am now sitting at ~40%. The market seems to be rebalancing, with certain sectors being punished signicantly (tech, health), and I’m looking for opportunities to get back in. Also been looking at bonds, and microloans to leverage the high interest rates, but not finding anything particularly compelling yet. Things still feel quite unsure to me.