Quiet Contrarian. Ep 63: Half Year Portfolio Update 2025

Portfolio Performance

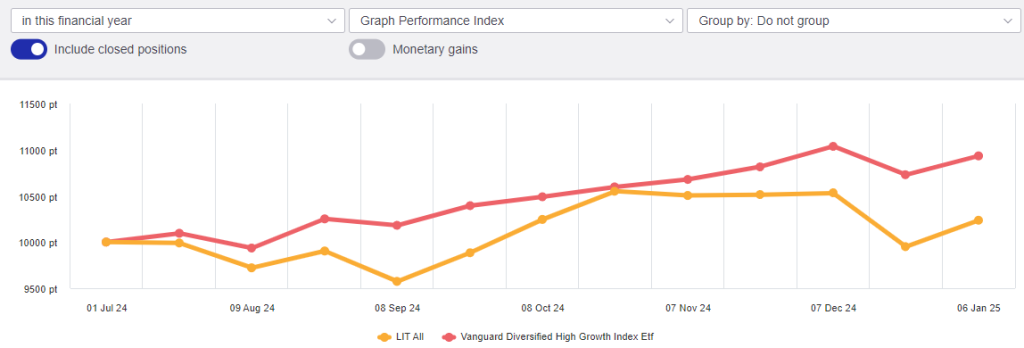

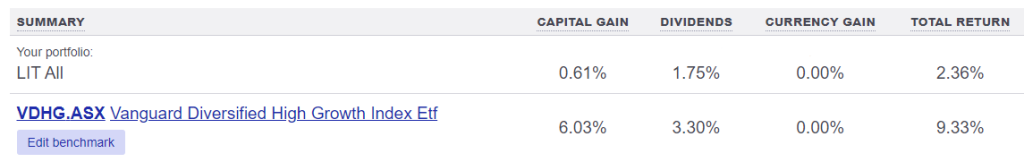

Well, it was bound to happen. Not a great year so far. On the upside, I haven’t lost any money, and like the gains through Sept and Oct show, it’s possible to close the gap quickily. I’m not worried yet. But will definitely do some housekeeping to round out the EOFY. Underperformed all my benchmarks this year. Haven’t put in the US benchmark, as I am all out of my US stocks at the moment. Here’s a bit of background on the Benchmarks I’ve been using:

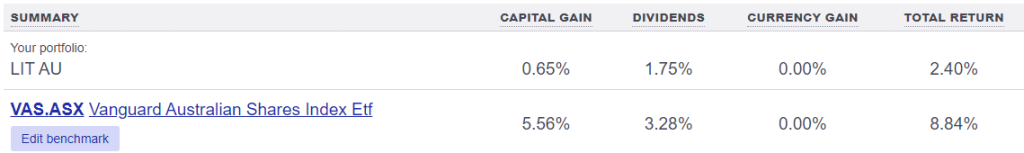

- VAS – Vanguard Australian Shares ETF – Tracks the S&P/ASX 300 Index – Best for comparison to the Australian market

- VOO – Vanguard S&P 500 – Tracks the United States S&P 500 Index, in USD – This is best for a direct comparison of USD stocks.

- VDHG – Vanguard Diversified High Growth Index ETF – This is a composite ETF tracking a number of indexes. – This is meant to be a globally diversified “all-weather” option. One of the favourite fire and forget/DCA options for the /fiaustralia reddit group.

I have found the last year or so quite confusing in terms of the markets, and knowing where I want to position myself. I am struggling to pick trends I want to back and there seems to be quite alot of uncertainty, that isn’t being reflected in some of the extremely high valuations in the market. I also feel like I have been a bit corrupted by believing forecasts, and short term thinking. I want to get back to my 2+ year timeline outlook.

I didn’t make any trades in December.

Best and worst performers

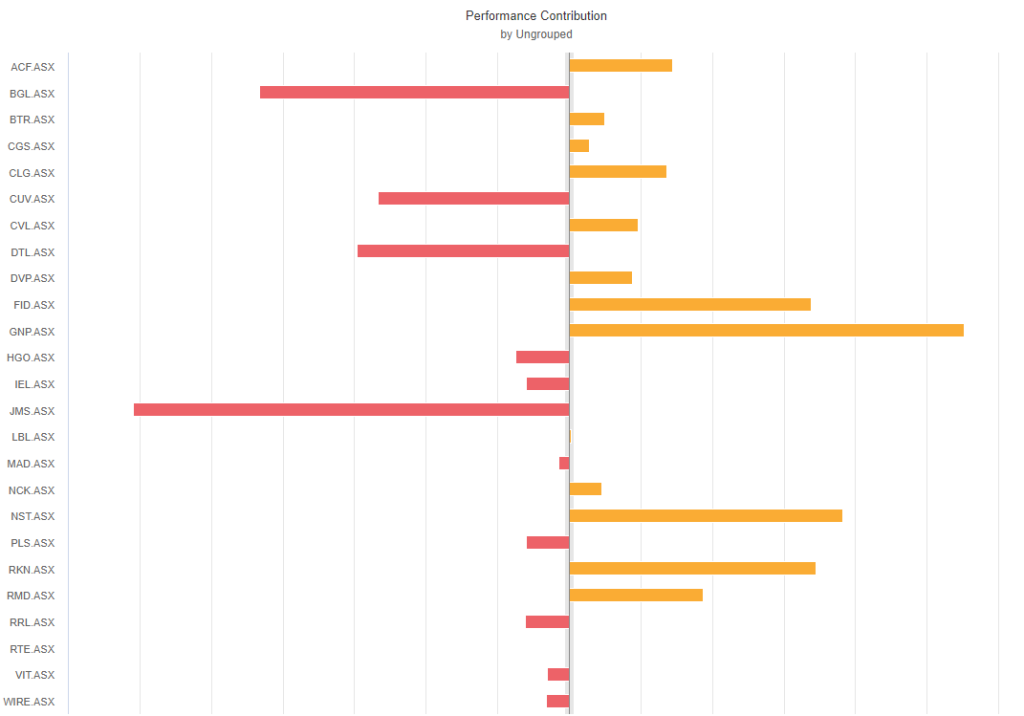

- The top 3 profitable holdings for the half year in dollar terms were: Genusplus Group Ltd, Northern Star Ltd, and Reckon Ltd.

- The best performers in % terms were: Reckon Ltd, Genusplus Group, and Resmed Inc.

Genusplus were part of my pivot into decarbonisation, a major beneficiary of the long term electrification infrastructure work. I’m happy for this to be a long hold, but I am wary, and need to keep an eye as they are expensive, and their share price could turn if their pipeline shows any indication of slowing. Northern Star are a legendary gold miner, and have been gaining momentum. Starting their first big news acquisition since legendary dealmaker Beament left the company a few years ago. This could be a good sell point. Will keep looking. Reckon has jumped into the top 3 based on acquisition news just before Christmas. Resmed was a good grab, based on (what I believe) was overhyped Ozempic news, though I didn’t load up that much as they didn’t get as cheap as I’d have liked.

- The worst 3 loss making holdings have been: Jupiter Mines, Bellevue Gold Ltd, and Data#3 Ltd

- The worst performers in % terms were: Jupiter Mines, Bellevue Gold Ltd, and Pilbara Minerals Ltd.

Jupiter Mines needs to be unloaded. I missed a great opportunity to unload them by getting greedy, and then road them all the way back down to their lowest point. Lots of uncertainty through the Mn market, and what seems like increasing global risk. Looking for opportunities to unload them. Bellevue Gold dropped significantly on acquistion news. I need to review to see if I think the acquisition is worth it. But my initial instinct is that it’s a well run company and this could be a good buy in point. Data#3 dropped due to a PE contraction, they are performing well, but overpriced. I only have a small amount of my initial holding left, happy to just sit on this and sell the next time they get into my top 3 list. Pilbara is my last remaining Li survivor. Lithium has been destroyed in the last year, and I wisely sold down almost everything last FY, just holding a tiny position in these guys, to keep an eye on them.

Goals and positioning review

To review my positioning and the timelines on my investments, I’d like to get back to a 2 year holding time, and to pick beaten down quality companies. Lets revert to my contrarian roots.